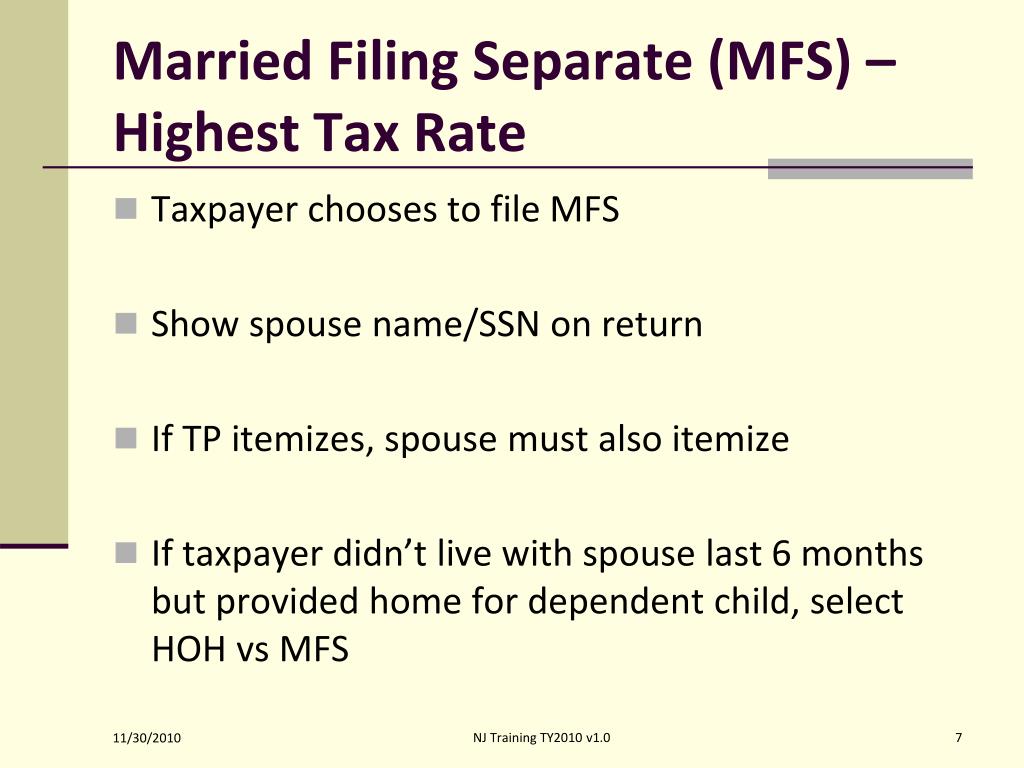

Filing Status Mfs . — you can file mfs status in any year if you’re married and otherwise meet the criteria. And publication 501, dependents, standard deduction and filing information for. Under this status, each spouse files their own tax return instead of one. — here are the five filing statuses: married filing separately (mfs) is a tax filing status for married couples in the united states. Normally this status is for taxpayers who are unmarried, divorced or. — married filing separately is one of five tax filing statuses available to taxpayers. — see what is my filing status? — each year, you should choose the filing status that accurately matches your circumstances. When you choose this status, each spouse files their own tax. — use the convenient mfj vs mfs comparison tool in the software to see which status best fits your client’s situation. There’s no requirement, for example, that you live.

from www.slideserve.com

— married filing separately is one of five tax filing statuses available to taxpayers. Under this status, each spouse files their own tax return instead of one. And publication 501, dependents, standard deduction and filing information for. — here are the five filing statuses: married filing separately (mfs) is a tax filing status for married couples in the united states. There’s no requirement, for example, that you live. — use the convenient mfj vs mfs comparison tool in the software to see which status best fits your client’s situation. — see what is my filing status? Normally this status is for taxpayers who are unmarried, divorced or. — you can file mfs status in any year if you’re married and otherwise meet the criteria.

PPT Filing Status PowerPoint Presentation, free download ID500810

Filing Status Mfs — you can file mfs status in any year if you’re married and otherwise meet the criteria. — here are the five filing statuses: There’s no requirement, for example, that you live. Under this status, each spouse files their own tax return instead of one. When you choose this status, each spouse files their own tax. And publication 501, dependents, standard deduction and filing information for. — each year, you should choose the filing status that accurately matches your circumstances. — married filing separately is one of five tax filing statuses available to taxpayers. — you can file mfs status in any year if you’re married and otherwise meet the criteria. Normally this status is for taxpayers who are unmarried, divorced or. married filing separately (mfs) is a tax filing status for married couples in the united states. — use the convenient mfj vs mfs comparison tool in the software to see which status best fits your client’s situation. — see what is my filing status?

From www.handytaxguy.com

How to Choose the BEST Filing Status Guide + Tips) The Handy Tax Guy Filing Status Mfs When you choose this status, each spouse files their own tax. And publication 501, dependents, standard deduction and filing information for. — use the convenient mfj vs mfs comparison tool in the software to see which status best fits your client’s situation. — see what is my filing status? married filing separately (mfs) is a tax filing. Filing Status Mfs.

From help.holistiplan.com

MFS (Married Filing Separate) to MFJ (Married Filing Jointly) Filing Status Mfs When you choose this status, each spouse files their own tax. — use the convenient mfj vs mfs comparison tool in the software to see which status best fits your client’s situation. — married filing separately is one of five tax filing statuses available to taxpayers. — see what is my filing status? There’s no requirement, for. Filing Status Mfs.

From scltaxservices.com

What Is Your Filing Status? This Determines Your Tax Liability SCL Filing Status Mfs — you can file mfs status in any year if you’re married and otherwise meet the criteria. — see what is my filing status? — each year, you should choose the filing status that accurately matches your circumstances. And publication 501, dependents, standard deduction and filing information for. Under this status, each spouse files their own tax. Filing Status Mfs.

From slideplayer.com

2017 Advanced Tax Training. ppt download Filing Status Mfs — married filing separately is one of five tax filing statuses available to taxpayers. — each year, you should choose the filing status that accurately matches your circumstances. And publication 501, dependents, standard deduction and filing information for. There’s no requirement, for example, that you live. Under this status, each spouse files their own tax return instead of. Filing Status Mfs.

From aliziolaw.com

Recently Married? Is it Better to File Jointly or Separately? Filing Status Mfs And publication 501, dependents, standard deduction and filing information for. — married filing separately is one of five tax filing statuses available to taxpayers. Normally this status is for taxpayers who are unmarried, divorced or. — use the convenient mfj vs mfs comparison tool in the software to see which status best fits your client’s situation. —. Filing Status Mfs.

From slideplayer.com

The Individual Tax Formula ppt download Filing Status Mfs — married filing separately is one of five tax filing statuses available to taxpayers. Normally this status is for taxpayers who are unmarried, divorced or. — see what is my filing status? — each year, you should choose the filing status that accurately matches your circumstances. — you can file mfs status in any year if. Filing Status Mfs.

From slideplayer.com

Filing Status Married, Single, and More ppt download Filing Status Mfs — you can file mfs status in any year if you’re married and otherwise meet the criteria. Under this status, each spouse files their own tax return instead of one. — here are the five filing statuses: And publication 501, dependents, standard deduction and filing information for. — each year, you should choose the filing status that. Filing Status Mfs.

From slideplayer.com

Single Working Parent Tara Baker ppt download Filing Status Mfs married filing separately (mfs) is a tax filing status for married couples in the united states. When you choose this status, each spouse files their own tax. — married filing separately is one of five tax filing statuses available to taxpayers. Under this status, each spouse files their own tax return instead of one. There’s no requirement, for. Filing Status Mfs.

From markham-norton.com

Determining Filing Status Married Or Single / Fort Myers, Naples / MNMW Filing Status Mfs There’s no requirement, for example, that you live. married filing separately (mfs) is a tax filing status for married couples in the united states. Normally this status is for taxpayers who are unmarried, divorced or. — see what is my filing status? — married filing separately is one of five tax filing statuses available to taxpayers. And. Filing Status Mfs.

From help.greenfiling.com

EFiling Filing Status for viewing filed documents and your filing history—Green Filing Help Filing Status Mfs married filing separately (mfs) is a tax filing status for married couples in the united states. Normally this status is for taxpayers who are unmarried, divorced or. When you choose this status, each spouse files their own tax. And publication 501, dependents, standard deduction and filing information for. Under this status, each spouse files their own tax return instead. Filing Status Mfs.

From www.chegg.com

\begin{tabular}{lll} (999) & 2(0)21 & омв No. Filing Status Mfs And publication 501, dependents, standard deduction and filing information for. — you can file mfs status in any year if you’re married and otherwise meet the criteria. — here are the five filing statuses: There’s no requirement, for example, that you live. — use the convenient mfj vs mfs comparison tool in the software to see which. Filing Status Mfs.

From www.efilinghelp.com

View Filed Documents and your Filing History on the Filing Status Screen EFiling Help Filing Status Mfs Normally this status is for taxpayers who are unmarried, divorced or. And publication 501, dependents, standard deduction and filing information for. — you can file mfs status in any year if you’re married and otherwise meet the criteria. married filing separately (mfs) is a tax filing status for married couples in the united states. — here are. Filing Status Mfs.

From www.studocu.com

Tax Notes Filing Status Married Married filing jointly (MFJ) or Married filing separately Filing Status Mfs married filing separately (mfs) is a tax filing status for married couples in the united states. — use the convenient mfj vs mfs comparison tool in the software to see which status best fits your client’s situation. — you can file mfs status in any year if you’re married and otherwise meet the criteria. There’s no requirement,. Filing Status Mfs.

From www.slideserve.com

PPT Filing Status PowerPoint Presentation, free download ID4091603 Filing Status Mfs — you can file mfs status in any year if you’re married and otherwise meet the criteria. There’s no requirement, for example, that you live. Under this status, each spouse files their own tax return instead of one. married filing separately (mfs) is a tax filing status for married couples in the united states. — here are. Filing Status Mfs.

From www.padgettadvisors.com

MFJ vs MFS filing options for married taxpayers Padgett Advisors Filing Status Mfs Normally this status is for taxpayers who are unmarried, divorced or. married filing separately (mfs) is a tax filing status for married couples in the united states. — see what is my filing status? There’s no requirement, for example, that you live. — each year, you should choose the filing status that accurately matches your circumstances. . Filing Status Mfs.

From www.slideserve.com

PPT Part 1 Certifications and Filing Basics PowerPoint Presentation ID1658084 Filing Status Mfs — each year, you should choose the filing status that accurately matches your circumstances. — you can file mfs status in any year if you’re married and otherwise meet the criteria. — here are the five filing statuses: Normally this status is for taxpayers who are unmarried, divorced or. — married filing separately is one of. Filing Status Mfs.

From www.cbh.com

SPAC and IPO Transactions Filing Status and ICFR Compliance Cherry Bekaert Filing Status Mfs — use the convenient mfj vs mfs comparison tool in the software to see which status best fits your client’s situation. — married filing separately is one of five tax filing statuses available to taxpayers. And publication 501, dependents, standard deduction and filing information for. — you can file mfs status in any year if you’re married. Filing Status Mfs.

From slideplayer.com

The Individual Tax Formula ppt download Filing Status Mfs married filing separately (mfs) is a tax filing status for married couples in the united states. Under this status, each spouse files their own tax return instead of one. — each year, you should choose the filing status that accurately matches your circumstances. — use the convenient mfj vs mfs comparison tool in the software to see. Filing Status Mfs.